Introduction: Why You Need Crypto Tax Software in 2025

Cryptocurrency investing has gone mainstream. Millions of users now buy, sell, stake, and trade crypto across dozens of exchanges and wallets. But with the rise of digital assets comes the often-http://Best Crypto Wallets for Tax Season 2025overlooked complexity of crypto taxes. Unlike traditional investments, cryptocurrency transactions can be hard to track — and mistakes can lead to hefty fines or audits from the IRS.

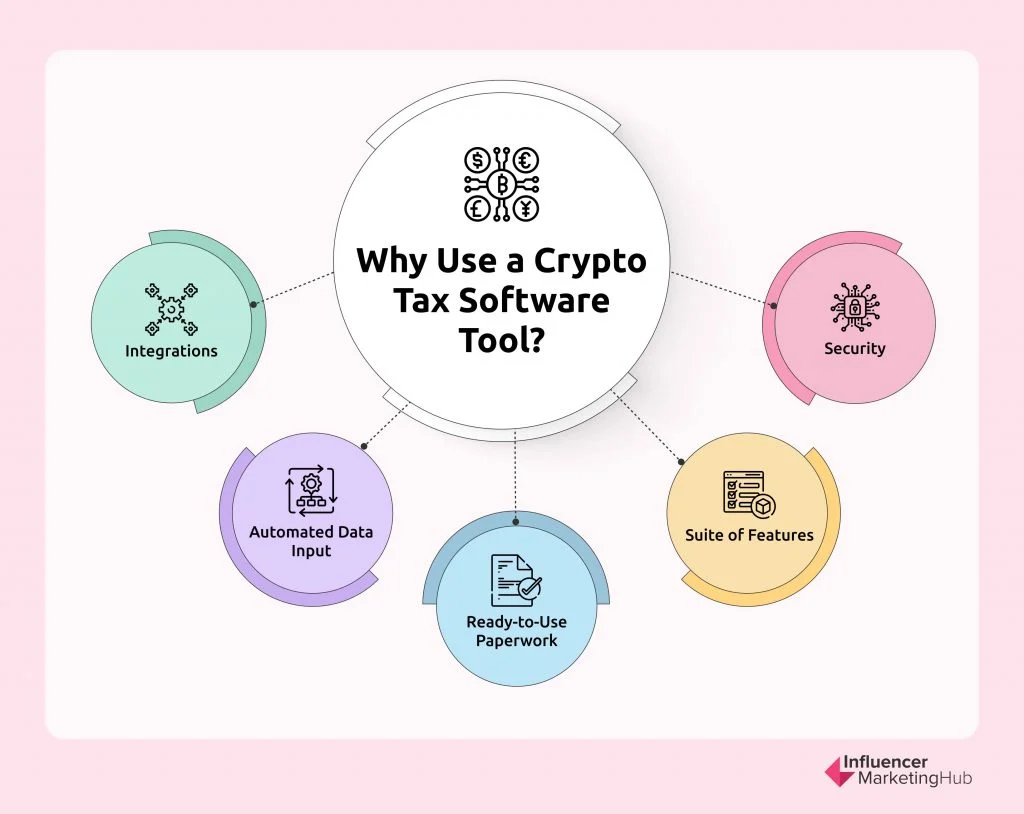

That’s where crypto tax software comes in. These tools automatically track your trades, calculate gains and losses, and generate IRS-compliant tax reports. In this article, we’ll break down what crypto tax software is, why it’s essential, and review the top 7 crypto tax software platforms for 2025.

What Is Crypto Tax Software?

Crypto tax software is a digital tool that connects to your crypto wallets and exchanges to automatically import and categorize your transactions. It calculates your capitalhttps://www.cointracker.io gains or losses, income from staking or mining, and generates the appropriate tax documents like Form 8949 and Schedule D.

Key Features:

- Auto-import transactions from wallets and exchanges

- Classify trades (short-term, long-term, income)

- Generate IRS tax reports

- Integrate with TurboTax, TaxAct, or CPAs

- Handle DeFi, NFTs, and staking income

Table of Contents

Why Crypto Tax Software Matters

Cryptocurrency is considered property by the IRS, meaning every trade, conversion, or use is a taxable event. Manually tracking this is not only time-consuming but error-prone.

Here’s why you need crypto tax software:

✅ Saves hours (or days) of manual work

✅ Avoids tax penalties and audits

✅ Automatically handles complex transactions

✅ Supports DeFi, NFTs, and cross-chain swaps

✅ Integrates with your tax filing software or accountant

Top 7 Crypto Tax Software Tools for 2025

Let’s dive into the best options available today.

1. Koinly – Best All-Around Crypto Tax Software

Website: https://koinly.io

Overview:

Koinly is a highly rated, user-friendly crypto tax software that supports 700+ integrations and provides detailed tax reports. It’s ideal for beginners and advanced traders alike.

Key Features:

- 300+ exchanges supported

- NFT, DeFi, and margin support

- International tax reporting (UK, Canada, Australia, etc.)

- Real-time portfolio tracker

Pros:

- Easy to use

- Free tax preview

- Great for global users

Cons:

- Premium plans required for full reports

Pricing:

Free for up to 10,000 transactions. Paid plans start at $49/year.

2. CoinTracker – Best for TurboTax Users

Website: https://www.cointracker.io

Overview:

CoinTracker is one of the most trusted names in crypto tax, backed by Coinbase and integrated directly with TurboTax and H&R Block.

Key Features:

- Auto-sync with Coinbase, Binance, Kraken

- Portfolio tracking across devices

- DeFi and NFT support

- IRS form generation

Pros:

- Seamless integration with tax filing platforms

- User-friendly mobile app

- Real-time price tracking

Cons:

- Pricier than some competitors

- May miss smaller DeFi protocols

Pricing:

Free basic plan, paid starts at $59/year.

3. TokenTax – Best for Full-Service Tax Filing

Website: https://www.tokentax.co

Overview:

TokenTax is more than just crypto tax software—it’s also a full-service tax firm. Ideal for high-net-worth users and complex portfolios.

Key Features:

- Human CPA review options

- Mining, staking, and airdrop support

- CSV and API imports

- Handles international tax rules

Pros:

- Offers full tax filing services

- Great for complex traders

- Responsive customer support

Cons:

- Higher cost than DIY tools

- Interface less beginner-friendly

Pricing:

Starts at $65/year, Full Filing plan begins at $199.

4. CoinLedger (Formerly CryptoTrader.Tax) – Fast and Easy Reporting

Website: https://www.coinledger.io

Overview:

CoinLedger is built for simplicity. It’s ideal for traders who want quick, accurate reporting without all the bells and whistles.

Key Features:

- Integrates with major exchanges

- Auto-generates IRS forms

- Easy CSV import/export

- NFT and staking supported

Pros:

- Very easy setup

- Fast tax report generation

- Great UI for beginners

Cons:

- Fewer features for power users

Pricing:

Starts at $49/year based on number of transactions.

5. Accointing – Best for Portfolio Analysis

Website: https://www.accointing.com

Overview:

Now owned by Glassnode, Accointing offers both tax filing and powerful portfolio analysis tools.

Key Features:

- Smart tax optimization

- Mobile and desktop versions

- CSV & API exchange integrations

- Wallet & address tracking

Pros:

- Great for portfolio management

- Clear visualizations

- Useful for tracking PnL (profit/loss)

Cons:

- Support for DeFi and NFTs still evolving

Pricing:

Free for up to 25 transactions. Paid plans from $79/year.

6. ZenLedger – IRS-Partnered Tax Tool

Website: https://www.zenledger.io

Overview:

ZenLedger is IRS-partnered and trusted by accountants, with a strong focus on tax compliance and audit defense.

Key Features:

- Tax-loss harvesting

- CPA tools and integrations

- DeFi and NFT compatible

- IRS Form 8949, Schedule D, FBAR generation

Pros:

- Great for CPAs and accountants

- Tax loss harvesting included

- Trusted by institutional users

Cons:

- More complex setup

- Pricier for active traders

Pricing:

Starts at $49/year. Premium plans can exceed $399/year.

7. TaxBit – Best for Institutional and Enterprise Use

Website: https://www.taxbit.com

Overview:

Founded by CPAs and backed by PayPal and Coinbase, TaxBit is designed for both individuals and institutions.

Key Features:

- Institutional-level audit trail

- IRS-ready reports

- Built-in support for exchanges and wallets

- Web3, DeFi, and staking supported

Pros:

- IRS-approved

- Clean UI

- Full Web3 transaction support

Cons:

- Less suitable for hobby traders

- Limited support for small exchanges

Pricing:

Free version available. Paid plans from $50/year.

How to Choose the Right Crypto Tax Software

✅ Consider the following before choosing:

| Factor | Description |

|---|---|

| Exchange Compatibility | Make sure the platform supports your exchanges (Coinbase, Binance, etc.) |

| DeFi/NFT Support | Important if you use Web3 platforms |

| Tax Filing Integrations | TurboTax, TaxAct, or CPA-ready? |

| Audit Defense | Offers IRS support or CPA backup? |

| User Interface | Easy to use or more technical? |

| Pricing Model | Based on transaction count or flat fee? |

Common Taxable Crypto Events

Your crypto tax software must account for these:

- Selling crypto for fiat (e.g., BTC → USD)

- Trading crypto for another crypto (e.g., ETH → SOL)

- Spending crypto on goods or services

- Earning crypto from:

- Mining

- Staking

- Airdrops

- Yield farming

- Receiving NFTs or tokens as rewards

Integrating With Tax Filing Software

Most top crypto tax platforms integrate with:

- TurboTax

- H&R Block

- TaxAct

- CPA-friendly CSV exports

These integrations simplify your tax filing and ensure accurate capital gains or income reporting.

Is Crypto Tax Software Safe?

Yes, leading crypto tax tools follow security best practices:

- Data encryption

- 2FA (two-factor authentication)

- No access to private keys

- Secure read-only API connections

Always check if the provider has a privacy policy, data protection practices, and transparent terms of use.

Crypto Tax in the USA: Quick Overview (2025)

- The IRS treats crypto as property.

- Capital gains tax applies when you sell, spend, or trade.

- Short-term gains (held under 1 year) are taxed at ordinary income rates.

- Long-term gains (held over 1 year) enjoy reduced tax rates.

- Crypto income (staking, mining, airdrops) is taxed as ordinary income.

- You must report all crypto activity on Form 8949 and Schedule D.