In 2025, FHA (Federal HousingLoan Requirements Administration) loans remain one of the most popular options for homebuyers, especially for those who might nothttp://(yourdomain.com/first-time-homebuyer-guide have the ideal credit score or a hefty down payment. This government-backed mortgage program offers more flexibility and lower barriers to entry compared to conventional loans. In this guide, we will explore the FHA loan requirements in 2025, eligibility criteria, benefits, and how to apply for an FHA loan.

What is an FHA Loan?

An FHA loan is a type of mortgageLoan Requirements that is insured by the Federal Housing Administration. The FHA itself doesn’t lend money to homebuyers but rather insures loans madehttps://www.hud.gov/program_offices/housing/fhahistory) by approved lenders. This insurance allows lenders to offer more favorable terms, including lower interest rates and down payment requirements, to borrowers who might not qualify for conventional loans.

FHA loans are typically used by first-time homebuyers, low-to-moderate-income individuals, and those with less-than-perfect credit. These loans have been a cornerstone of the housing market in the United States for decades, helping millions of people become homeowners.

Table of Contents

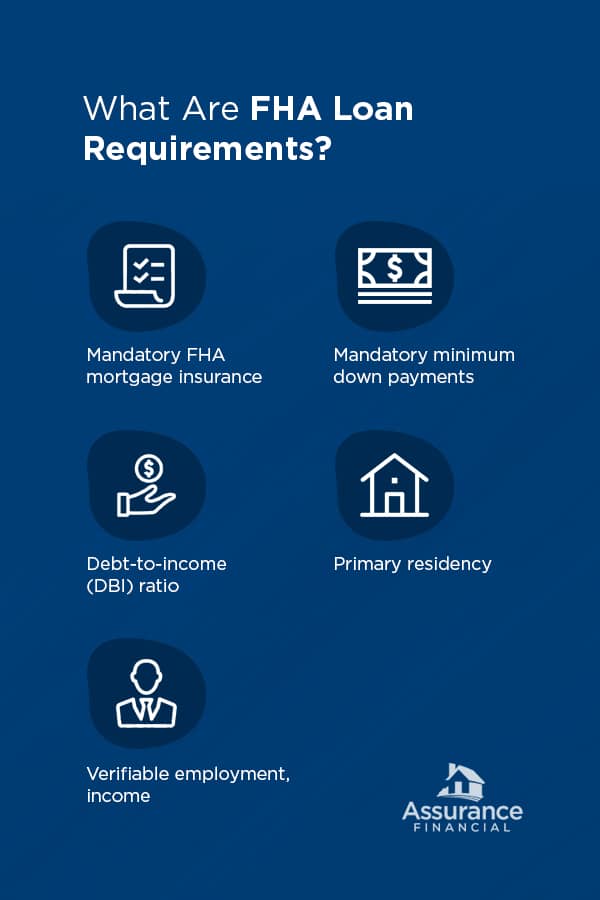

FHA Loan Requirements in 2025

As we move into 2025, FHA loansLoan Requirements continue to have certain specific requirements that must be met in order for a borrower to qualify. While these requirements have remained relatively stable in recent years, it’s important to be aware of any changes or adjustments that may occur as the housing market evolves.

1. Credit Score Requirements

One of the keyLoan Requirements features of FHA loans is that they offer more lenient credit score requirements compared to conventional loans. In 2025, borrowers applying for an FHA loan should expect the following:

- Minimum Credit Score for 3.5% Down Payment: To qualify for the standard FHA loan with a 3.5% down payment, borrowers generally need a credit score of 580 or higher.

- Credit Score Below 580: If your credit score is between *500 and 579, you may still qualify for an FHA loan, but you will likely need to provide a larger down payment of *10%.

- Credit Score Below 500: Borrowers with a credit score under 500 are typically not eligible for FHA loans.

It is important to note that while FHA loans are more lenient in terms of credit score, lenders may have their own requirements, which could be stricter than the FHA’s baseline guidelines.

2. Down Payment Requirements

One of the most attractive features of an FHA loan is the low down payment requirement. As of 2025, borrowers can expect the following down payment scenarios:

- 3.5% Down Payment: This is the standard down payment for those with a credit score of 580 or higher.

- 10% Down Payment: If your credit score is between 500 and 579, a down payment of 10% will generally be required.

- Gift Funds: FHA allows down payment funds to come from family members or other eligible sources in the form of a gift. This is beneficial for first-time homebuyers who might not have a large savings balance.

3. Debt-to-Income (DTI) Ratio

The Debt-to-Income (DTI) ratio is a measure of a borrower’s monthly debt payments relative to their gross monthly income. This ratio helps lenders assess a borrower’s ability to repay the loan. In 2025, the FHA’s general guidelines for DTI are as follows:

- 36% to 43% DTI Ratio: FHA typically requires a DTI ratio of 43% or lower. However, some borrowers with higher DTIs (up to 50%) may still be approved if they have compensating factors like a higher income or a larger down payment.

- Compensating Factors: If your DTI exceeds 43%, but you have other strong financial attributes, such as a large savings balance, a stable job history, or a low loan amount, you may still be eligible for an FHA loan.

4. Property Requirements

The property being purchased with an FHA loan must meet certain conditions to ensure it is safe, habitable, and suitable for a home loan. These requirements include:

- Appraisal: An FHA-approved appraiser must inspect the property to ensure it meets the necessary safety, health, and structural standards. The property must not have major issues like peeling paint, mold, or a damaged foundation.

- Primary Residence: The borrower must use the property as their primary residence. FHA loans are not available for second homes or investment properties.

- Loan Limits: FHA loan limits vary by county and are based on the median home prices in that area. In 2025, these limits will likely reflect the ongoing changes in the real estate market. Generally, FHA loan limits can range from \$300,000 to more than \$1 million in high-cost areas.

5. Employment and Income History

To qualify for an FHA loan in 2025, borrowers must have a steady employment history. The general guideline is that you should have worked in the same job or field for at least two years. The income must also be consistent and sufficient to cover the monthly mortgage payment along with other debts.

- Self-Employed Borrowers: If you are self-employed, you will need to provide tax returns, profit and loss statements, and other relevant financial documentation for the past two years.

- Supplemental Income: If you receive supplemental income, such as alimony, child support, or rental income, it may be counted as part of your total income, but documentation will be required.

Benefits of FHA Loans

FHA loans come with several advantages, making them an attractive choice for first-time buyers and those with limited resources:

1. Lower Down Payments

As mentioned earlier, FHA loans allow for a down payment as low as 3.5% for borrowers with a credit score of 580 or higher. This is significantly lower than the typical 20% down payment requirement for conventional loans.

2. Flexible Credit Requirements

FHA loans are more forgiving when it comes to credit score. With a credit score as low as 500, borrowers can still secure a loan, provided they meet other eligibility criteria, such as a higher down payment.

3. Lower Interest Rates

FHA loans generally offer lower interest rates than conventional loans, which can result in substantial savings over the life of the loan. This is particularly beneficial for buyers who are looking to keep their monthly payments affordable.

4. Higher Loan Limits in High-Cost Areas

In expensive areas, FHA loan limits are higher than conventional loan limits, making it easier for borrowers to buy homes in metropolitan regions with high home prices.

5. Easier to Qualify for

The FHA’s more flexible requirements make it easier for a wider range of buyers to qualify for a mortgage. Whether you’re a first-time buyer or someone with less-than-perfect credit, an FHA loan may be a more accessible option than traditional loans.

FHA Loan vs. Conventional Loan: Key Differences

While FHA loans are great for many buyers, it’s important to understand how they compare to conventional loans. Here’s a quick overview:

| Criteria | FHA Loan | Conventional Loan |

|---|---|---|

| Credit Score Requirement | 580 (for 3.5% down payment) | 620 or higher |

| Down Payment | 3.5% (for credit score 580+) | 3% to 20%, depending on lender |

| Loan Limits | Set by county and home price area | Varies by lender and area |

| Private Mortgage Insurance (PMI) | Required if down payment < 20% | Required if down payment < 20% |

| Interest Rates | Lower than conventional loans | Generally higher for borrowers with lower credit scores |

How to Apply for an FHA Loan in 2025

Applying for an FHA loan is relatively straightforward, though it requires attention to detail. Here’s the general process:

- Check Eligibility: Ensure you meet the FHA’s credit score, down payment, and DTI requirements.

- Find a Lender: Not all lenders offer FHA loans, so it’s important to work with an FHA-approved lender.

- Pre-Approval: Most lenders will pre-approve you for an FHA loan after reviewing your financials. This involves submitting tax returns, pay stubs, and other relevant documentation.

- Choose a Home: Once pre-approved, start house hunting within your loan limits.

- Submit Your Application: After finding a home, submit the full loan application along with any additional documentation required.

- Loan Processing and Approval: The lender will process your application and schedule an FHA-approved appraisal for the property.

- Close on Your Home: Once the loan is approved, you’ll go through the closing process and finalize the purchase.

Conclusion

FHA loans in 2025 continue to be an excellent choice for many buyers, offering accessible homeownership options with lower down payments, flexible credit requirements, and lower interest rates. By understanding the FHA loan requirements and the benefits they offer, prospective homebuyers can make informed decisions and take the necessary steps to secure an FHA loan that suits their needs. Whether you’re a first-time homebuyer or someone with less-than-perfect credit, an FHA loan might be the ideal solution to achieving